The past few months have been nothing short of a whirlwind. Between my family, work and business, I sometimes find it overwhelming to equitably divide my time amongst all my commitments. Life often has a funny way of keeping us on our toes, doesn’t it? But amidst the chaos that our day-to-day life can bring, we have to find time for introspection and make the decision to get serious about the things that truly matter.

Similarly, in today’s vast landscape of investment options and an economy that is characterized by rising inflation and high-interest rates, it can be overwhelming to decide how to divide your hard-earned money.

From the stock market, to precious metals like gold and silver, to the roller coaster of cryptocurrency, and the ever-alluring realm of real estate, there are numerous avenues available to grow your wealth.

While there is no perfect investment, each option presents its own unique set of upsides and downsides. The key to success lies in capitalizing on the upside while minimizing the downsides.

Commercial real estate can be the perfect opportunity to make the most of today’s economic situation.

But before we dive into the specifics, let’s acknowledge that all investments, including real estate, come with their share of risks and rewards.

When it comes to the stock market, the potential for substantial gains is enticing. However, it can be simultaneously volatile and unpredictable. Precious metals like gold and silver have historically been considered safe havens during uncertain times. However, they lack the income-generating potential that commercial real estate offers.

Real estate, on the other hand, possesses a unique combination of being a tangible asset, being able to generate cash flow or income, and having the potential for long-term appreciation.

Real estate offers the advantage of being a tangible asset that has intrinsic value. Unlike stocks or precious metals, you have direct control over your investment through property management and strategic improvements. This control enables you to adapt to changing economic conditions, increase property value, and enhance rental income.

Rental income from properties can act as a consistent source of cash flow, even in today’s economy. Many people can no longer afford to own a home or pay for a modern Class A apartment or condo.

Class B and C apartments are not as nice or as expensive as the shiny new Class A apartments, but provide an affordable option during difficult financial times.

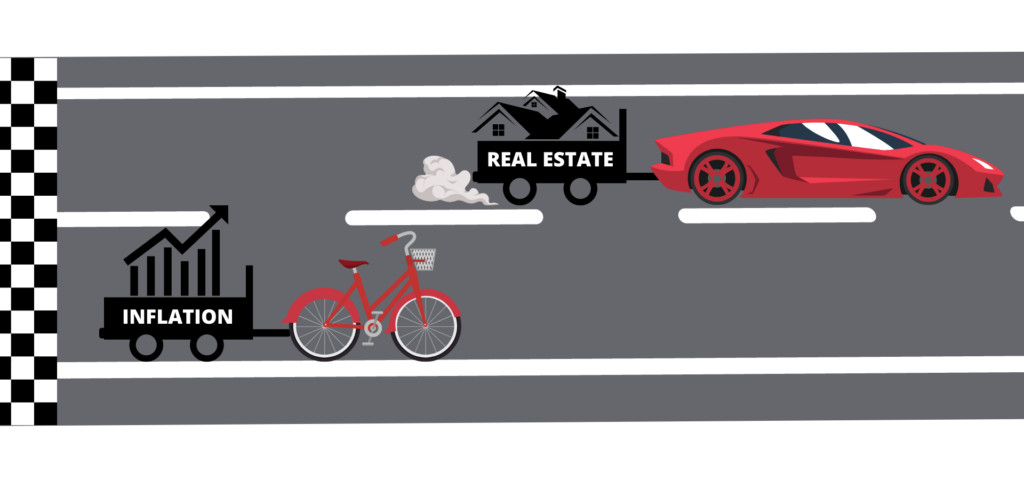

In addition, inflation is constantly eroding the value of traditional currency and real estate investments have historically demonstrated the potential to outpace inflation. As rental prices rise with inflation, real estate investors may potentially benefit from increased cash flow. This increase in rental income can also lead to appreciation of the asset.

It is important to understand that the value of commercial real estate is not calculated like the value of your home, by comparable sales in your area. In commercial real estate, property values are determined by the Net Operating Income (NOI) and the capitalization rate, which is set by the overall of the real estate market in that area.

The value of the property can be “forced” up by increasing the income of the property. This is called “forced appreciation”, and is directly increased by increasing the income and decreasing the expenses of the property.

Of course, it is essential to approach real estate investment with diligence and strategic planning. Thorough market research, careful property selection, and expert guidance and property management are paramount to success.

By partnering with experienced professionals, you can navigate the intricacies of real estate investing and capitalize on the opportunities presented by today’s economy.

In upcoming newsletters, we will explore the key factors to consider when investing of commercial real estate and share valuable insights to help you make informed decisions and make the most of your investment.

At Fortis Equity Group, we are dedicated to providing you with comprehensive guidance and support on your investment journey. From analysing market trends to understanding investing options in different asset classes, to mitigating risk, we will equip you with the knowledge and strategies needed to maximise your investment in any economy.

Please feel free to reach out to me if you have any further questions or would like to discuss your investment goals further.

Let’s have success together by seizing the opportunities and maximising the upside potential in commercial real estate investing in today’s economic environment!